Knowledge is M Power

Meeting the user needs of parents and children when launching a brand new child’s bank account

The M Power account is our new account for 11 to 15 year olds. It aims to help them spread their wings and gain financial independence - something that every parent wants for their child.

The project had a unique content design challenge to overcome. First and foremost, M Power needed to appeal to parents and guardians, so they'd open one for their child. It also needed to meet the needs of 11 to 15 year olds – typically a tough crowd to impress!

So who’s the target audience – kids or mum and dad?

An interesting dilemma for sure. A product that needs to speak to two very different audiences yet satisfy the user needs of both. We’re not afraid of a challenge in the Content Design team, so here’s how we tackled it.

Identifying user needs

Following some in-depth discovery research, we identified the core user needs.

As a parent or guardian, I want:

- to know what my child is spending their money on so I can help them manage it

- a quick and easy, digital opening of the account so I don’t have to go into a store or send away any paper documents

- it to be free

- safety measures in place so I know that my child and their money will be safe

- account benefits to help my child grow their savings

As a child, I want:

- control over my money so I feel more independent

- a contactless debit card – one that I’m happy for my friends to see

- a proper bank account, with a proper bank

- to know when money is spent on my account

Here’s what we delivered

A proper bank account that upgrades to an adult current account when they turn 18.

It’s got:

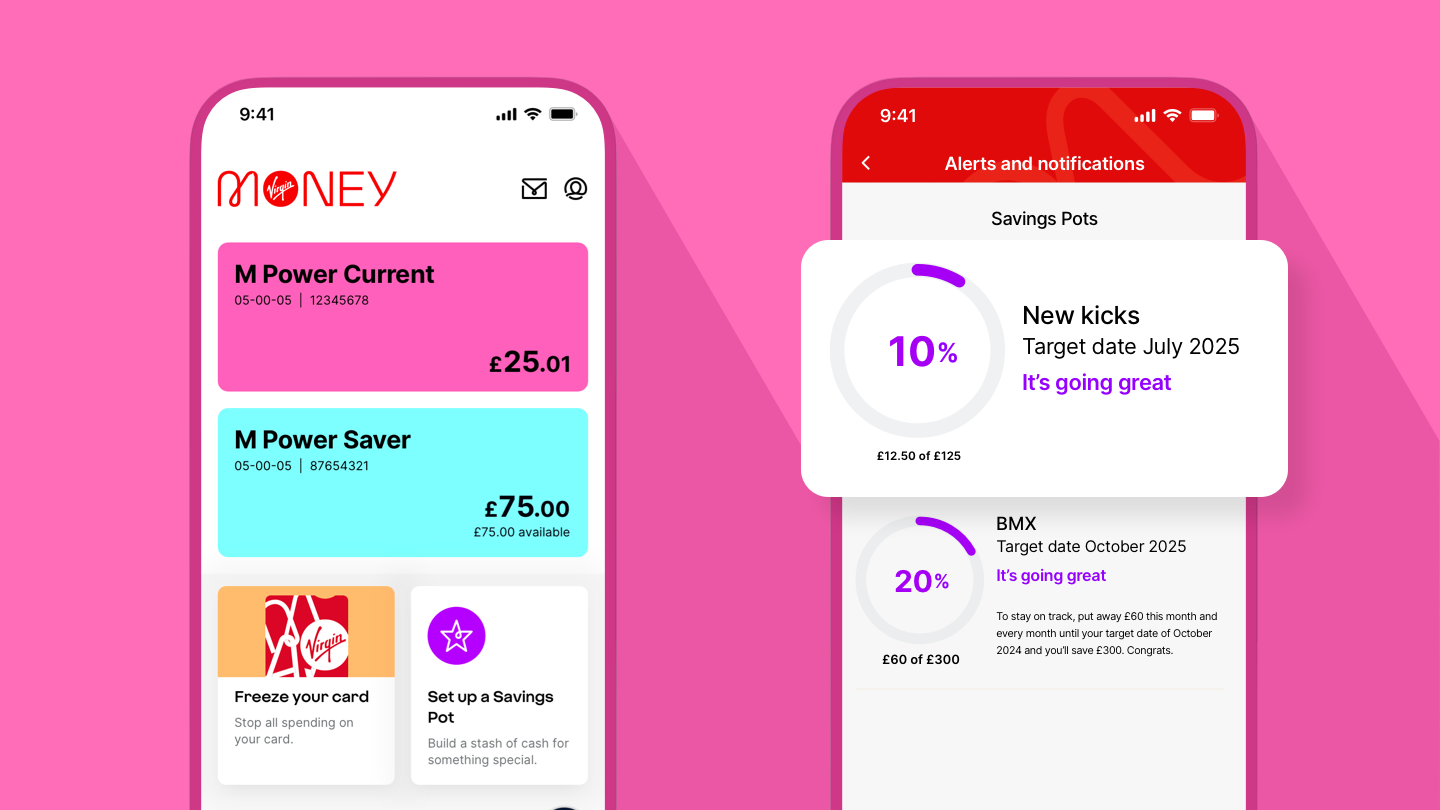

- A design led debit card, made from recycled plastic. It’s also Apple Pay & Google Pay ready.

- A kid friendly app where they can set up alerts and notifications on spending.

- A linked M Power Saver account with red-hot interest rates.

And for parents and guardians:

- First up, M Power is a free account with no fees.

- Parents have the power in their Virgin Money Mobile Banking app. They can give their kid’s account a nickname, see everything that’s going on and set up spending alerts.

- Parental peace of mind is key. There’s no overdraft and we’ll block spending on certain over-18 websites.

- No drama if the card is misplaced or stolen, it happens! Both child and parent can freeze the card in the app.

What we learned and how we put it into practice

Two’s company:

We quickly established that parents and guardians were the key people we needed to attract with the M Power proposition. They open the account on behalf of their child, and they need to have a Virgin Money current account to do so.

From user research we learned that most parents would sit with their child and discuss the account, using the website as the reference point. We needed to clearly articulate and sell the account benefits for them and their child.

Levelling up our language:

Our tone of voice can be quite bold, and we found that our initial concepts didn’t quite hit the mark.

Through further user research we discovered that simplicity was best. References to popular culture went over the head of parents and kids thought we were trying too hard.

We removed some of the words that distracted people from the core messages of the page and focused on providing a more ‘straight-up’ proposition.

Personalisation:

If we can, let’s call them by their name. This brings warmth to the onboarding journey and it’s just nicer to be called by your name rather than ‘the child’ or ‘the teen’. For example; ‘When was Alexandra born?’

Kid? Child? Teen? Youth?

So many options when personalisation wasn’t one. We focused on the SEO data and the terms people use when researching bank accounts for their 11 to 15 year olds. The SEO research helped identify that ‘child’ was the most common reference for this target age group – so we went with that.

Simplifying the complex:

As with all our content, we strive to write to a reading age of 11. We pushed this even further with this account, constantly challenging our reading age to drop it as much as possible.

You’ve got the M Power:

Ah the classic play on words. We love powering a brighter future, with power moves while we power on, M Power’ing your children. You know what they say…. Knowledge is M Power! We love having fun with words at Virgin Money and are not shy of a pun or two, but we try to do it sparingly!

Make it fun:

Who doesn’t love a quiz?! Learning about fraud has a reputation for being a little bit dull. How were we going to get a young person aged between 11 and 15 to engage with fraud content? Gamification is the answer. We developed a fraud quiz that’s both simple and effective in communicating some key ‘need to knows’ about spotting potential fraud.

Education, education, education:

We'd love to remove all the jargon from banking, but some words aren’t up to us to remove. We created a jargon buster to teach 11 to 15 year olds the key words they’ll need to know and level up their financial knowledge at the same time.

Check out our M Power Account.

The greatest gifts you can give your children are the roots of responsibility and the wings of independence.

Denis Waitley